The Bard Hernia Mesh Landscape in 2026

January 21, 2026 by Susan MohrBard Settlement vs. Covidien Growth: Where to Put Your Budget in 2026

For the last five years, MDL 2846 (In re: Davol, Inc./C.R. Bard, Inc.) has been a cornerstone of many mass tort inventories. However, following Becton Dickinson’s October 2024 announcement of a global settlement framework (approx. $1.9 billion reserved for ~38,000 claims), the strategy for 2026 has fundamentally shifted.

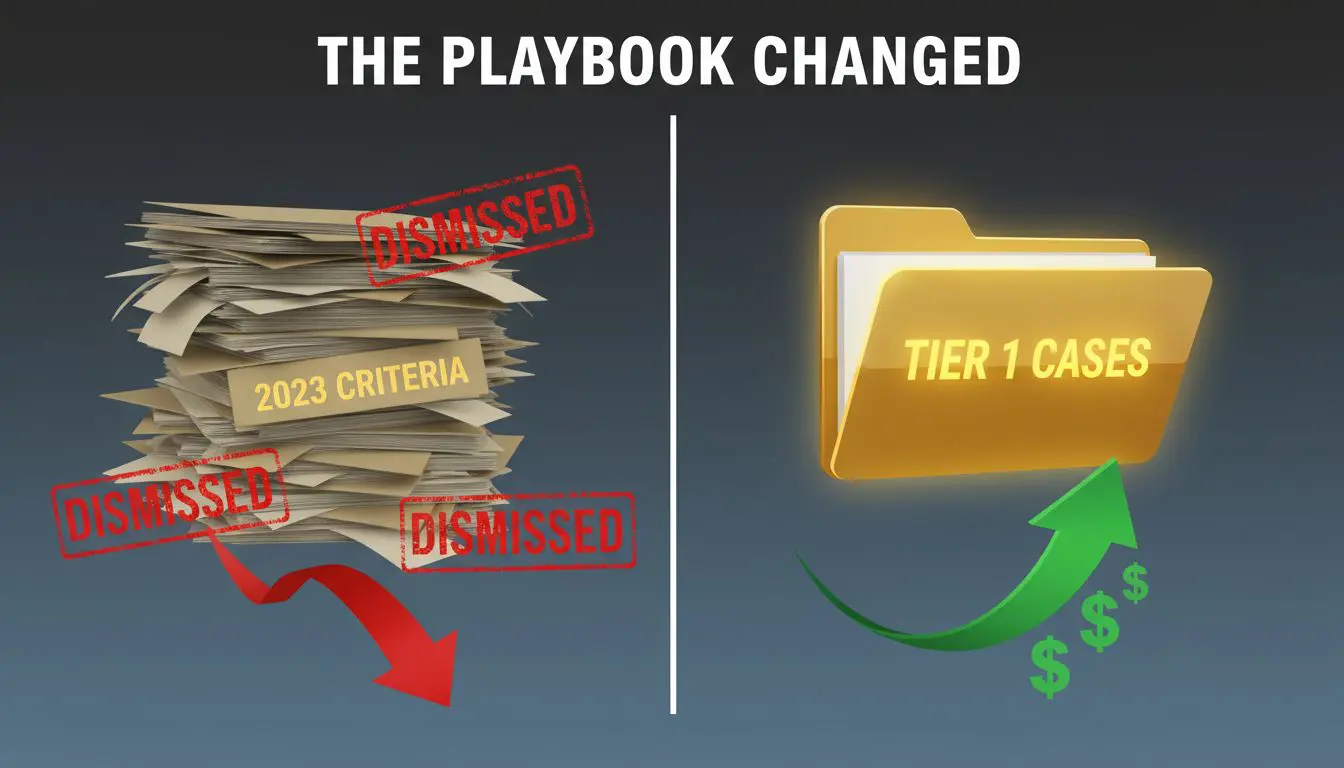

We are no longer in the “land grab” phase of 2022-2023. We have entered a Post-Settlement Administration phase where intake criteria must be surgical to survive the court’s new scrutiny.

Here is the executive brief on where the Bard litigation stands in January 2026 and how firms should adjust their acquisition and management strategies.

-

The “Intensive Settlement Process” (ISP)

The focus of Judge Sargus and the Special Masters (Ellen Reisman and John Jackson) has moved entirely to clearing the docket.

- Status: While the MDL officially remains “open” with over 24,000 pending actions, the litigation is functionally in a winding-down administrative phase.

- The Bottleneck: Firms are currently facing the “payment lag.” While the settlement framework is agreed upon, the administrative processing of tiers—verifying medical records against the settlement matrix—is creating significant delays in disbursement.

- Client Management: The primary challenge for firms right now is not litigation, but client retention and expectation management as payouts stretch over a multi-year timeline.

-

The New Hurdle: Lone Pine & CMO #53

If your firm is still acquiring Bard cases, your intake vetting must be flawless. The court has implemented strict Docket Control Orders (essentially Lone Pine orders) to prevent the filing of non-meritorious “inventory padding” cases.

The New Standard for Filing:

- Immediate Proof: New filings now often require a case-specific expert report or “Proof of Use” much earlier in the process.

- The Risk: Cases filed without definitive identification of a Bard product (vs. generic mesh) or clear evidence of revision are facing swift dismissal with prejudice.

- Strategy Shift: The “sign ’em up and sort ’em out” model is dead for this tort. Marketing vendors must be instructed to filter strictly for confirmed revision surgery with operative reports available, rather than just “symptoms.”

-

Is Bard Still “Buyable” Inventory?

Yes, but with caveats.

- The Opportunity: The statute of limitations resets upon the discovery of the injury. There remains a steady stream of plaintiffs who are only now undergoing revision surgery for implants placed 5-10 years ago.

- The Valuation: These “late-breaking” cases are potentially high-value “Tier 1” claims because the damages (revision) are fresh and documented. They are not part of the “stale” inventory that plagued early settlement talks.

- The Pivot: Many firms are keeping a “maintenance” ad budget for Bard to catch these high-value single cases while shifting their aggressive “growth” budget to emerging torts.

-

The Emerging Alternative: Covidien (MDL 3029)

As Bard moves into administration, the active litigation heat has shifted to Covidien (Medtronic) in MDL 3029 (District of Massachusetts).

- Trial Calendar: Unlike Bard, where trials are paused, Covidien has bellwether trials scheduled for 2026.

- Liability Theories: The allegations (polyester-based mesh degradation) differ from Bard’s polypropylene theories, offering a fresh angle for firms looking to diversify their mesh portfolios.

- Strategy: If your firm is looking for active litigation with trial pressure to drive value, the market attention is pivoting from Bard to Covidien.

-

Compliance & Lead Gen Implications

Given the user’s interest in ethical marketing and “Joint Advertising & Compliance Programs,” the Bard litigation serves as a case study in why compliance matters.

The firms that are suffering most right now are those that bought “cheap” leads from aggregators who did not verify product ID. Those cases are being purged from the MDL unpaid.

Best Practices for 2026 Intake:

- Tech-Enabled Vetting: Utilize tools like AI WebTracker® to ensure high-intent traffic rather than broad programmatic display which often yields “unsure” claimants.

- Bar Compliance: Ensure all retainer agreements and marketing materials for new Bard cases explicitly disclose the mature stage of the litigation to avoid ethical complaints regarding “misleading” promises of quick trials.

Let’s discuss your specific needs and how our Compliance Program, AI Lead Generation Technology, digital marketing, signed cases, and verified leads can help you achieve your growth goals.

Contact Mohr Marketing today for a custom quote

Best Wishes,

Sue Mohr

Recent Posts

- The Bard Hernia Mesh Landscape in 2026

- The “Hernia Mesh” bucket is no longer a single asset class

- Intake Protocol to Navigate Stricter 2026 Bard Hernia Mesh Docket

Categories

- AI and Lead Generation

- Business Financing

- Call Verified MVA Leads

- Car Accident Help

- Car Accident Settlements

- Claimant Funding

- Compliance Program

- Geotargeting

- Google Maps Ranking

- Healthcare Practice Growth

- Law Firm Growth

- Law Office Operations

- Lead Generation

- Lead Generation For Attorneys

- Lead Generation For Chiropractors

- Lead Generation For Criminal Attorneys

- Lead Generation For D&A Treatment Centers

- Lead Generation For DUI Attorneys

- Lead Generation For Eye Doctors

- Lead Generation For Family Law Practices

- Lead Generation For PI Law Firms

- Lead Generation For Plastic Surgeons

- Leads For Healthcare Professionals

- Leads For Insurance Industry

- Legal Leads

- Legal Marketing

- Legal Updates

- Mass Tort Leads

- Medicare and Medicaid Leads

- Merchant Funding Leads

- Online Marketing Strategies

- Pre-Settlement Funding

- Signed MVA Cases

- Tort Updates

- Truck Accident Settlements

- Web Design

Archives

Copyright © 1994-2025 Mohr Marketing, LLC. All Rights Reserved.