Top Lawsuit Funding Options | Get the Cash You Need

August 16, 2025 by Mohr Marketing

What Exactly Is Lawsuit Funding?

When you’re caught in a long, drawn-out legal battle, the pressure mounts fast. Medical bills don’t stop. Rent is still due. It can feel like you’re being squeezed from all sides. That’s where lawsuit funding can be a game-changer, offering you a cash advance against your future settlement to keep you financially stable.

Think of it this way: this isn’t a traditional loan. It’s a non-recourse advance, which is a fancy way of saying you only have to pay it back if you win your case.

Imagine you’re an independent contractor waiting on a huge invoice to clear, but you have bills to pay today. Lawsuit funding is a lot like getting an advance on that invoice. It’s a financial tool that gives you access to a piece of your potential settlement money long before the case actually wraps up.

This does more than just pay the bills; it levels the playing field. Big insurance companies are notorious for dragging things out, hoping you’ll get desperate enough to accept a lowball offer. With funding in your corner, you can push back against those pressure tactics. It gives your attorney the breathing room they need to fight for the full, fair compensation you truly deserve.

A Financial Lifeline, Not a Loan

To really get what lawsuit funding is, you have to understand how it stands apart from the many different funding options out there. Unlike a personal loan from a bank, legal funding isn’t about your financial past. It’s all about the strength of your case.

Here’s what makes it so different:

- No Credit Checks: Your credit score or job history? Completely irrelevant to the approval process.

- No Monthly Payments: You don’t pay a dime until your case is successfully resolved.

- Zero Risk to You: This is the most important part. Because it’s non-recourse, if you lose your case, you owe absolutely nothing. The funding company absorbs the loss.

This risk-free setup is what makes it such a powerful option for plaintiffs. It takes away the fear of racking up more debt just to see your case through to the end. At Mohr Marketing, we specialize in connecting people with funding partners who offer these plaintiff-friendly terms, giving you support without the stress. You can dive deeper into this process in our guide to pre-settlement legal funding you can trust.

Comparing Pre-Settlement and Post-Settlement Funding

When you start looking into lawsuit funding, you’ll quickly realize that timing is everything. The two main options hinge entirely on where you are in your legal journey: pre-settlement funding for when your case is still ongoing, and post-settlement funding for after you’ve already won.

Knowing the difference is critical. Each is built for a specific phase of the litigation process, offering a financial lifeline when you need it most.

Pre-Settlement Funding: The Common Lifeline

This is, by far, the most common form of legal finance out there. Pre-settlement funding gives you a non-recourse cash advance while your personal injury or mass tort lawsuit is still in the thick of it. Think of it like getting an advance on a potential year-end bonus; you get the money based on what your case is expected to be worth, not what it’s guaranteed to be.

This money is designed to keep you afloat—covering rent, medical bills, and all the other financial pressures that don’t stop just because you’re in a lawsuit. It gives you the power to say “no” to lowball settlement offers and lets your attorney fight for the full compensation you actually deserve.

The best part? It’s completely risk-free. If you don’t win your case, you owe nothing back. Period.

Post-Settlement Funding: Bridging the Gap to Payment

On the other side of the coin is post-settlement funding. This is for plaintiffs who have already won their case or officially accepted a settlement. The victory is secured, but the wait for the actual check can be excruciatingly slow, sometimes dragging on for months or even years because of appeals or administrative red tape.

This isn’t like an advance on a potential bonus—it’s more like an advance on a paycheck that’s been issued but just hasn’t cleared yet. The outcome is certain, so the risk for the funding company is much, much lower. This usually means you get better, more favorable terms. It’s all about getting you immediate access to money that’s already yours, so you can move on with your life.

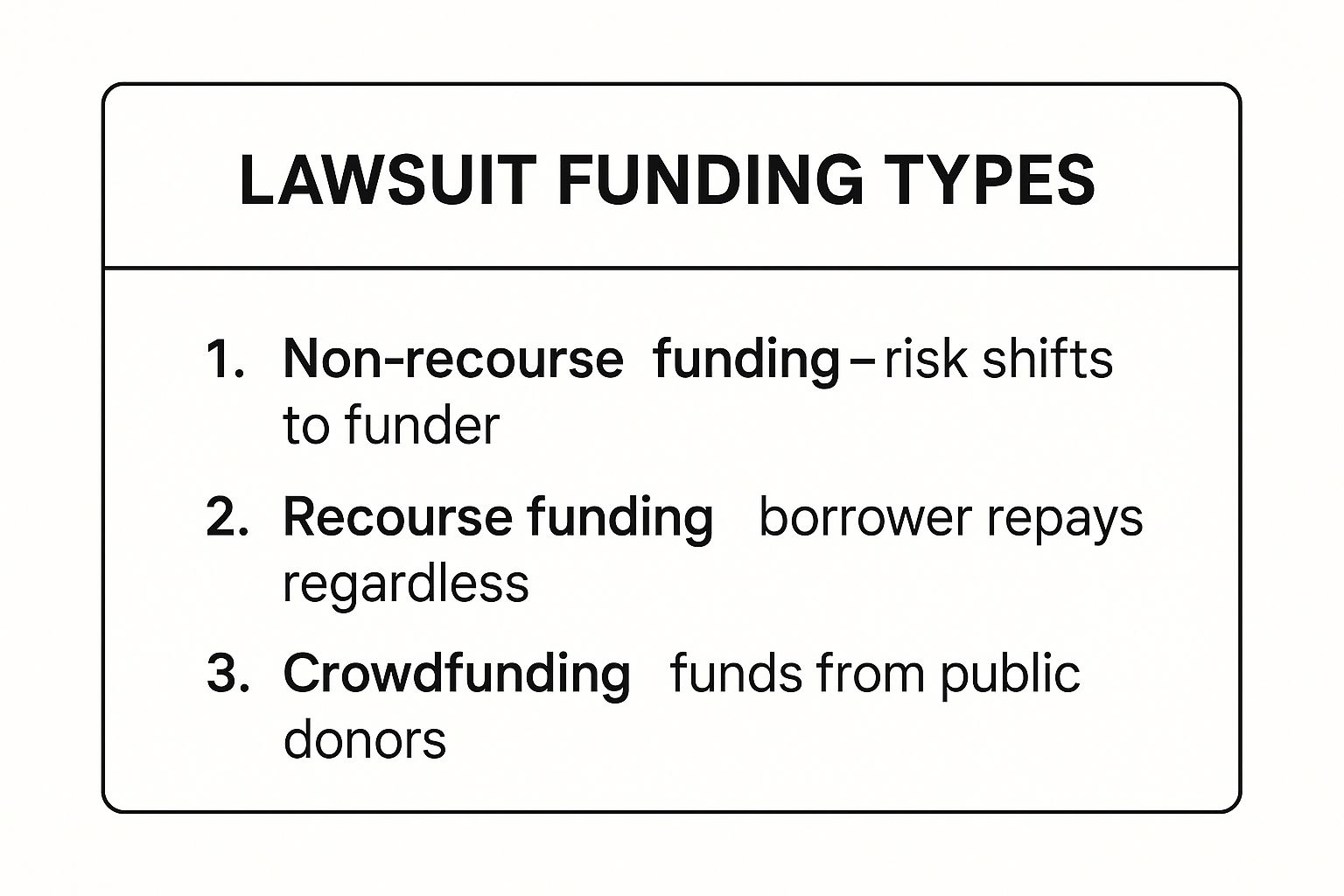

This chart breaks down the core lawsuit funding types to help you visualize where each one fits.

As the infographic shows, the key takeaway for both options is that they are typically non-recourse, meaning the financial risk stays with the funding company, not with you.

Pre-Settlement vs. Post-Settlement Funding at a Glance

To make it even clearer, let’s put the two main funding types side-by-side. This table breaks down the core differences to help you quickly see which path makes sense for your current situation.

| Feature | Pre-Settlement Funding | Post-Settlement Funding |

|---|---|---|

| Timing | During an active, ongoing lawsuit | After a case has been won or settled |

| Primary Purpose | Covers living expenses and bills to withstand a long legal fight | Provides immediate access to settlement funds stuck in administrative delays |

| Risk Level for Funder | Higher (case outcome is uncertain) | Lower (case outcome is guaranteed) |

| Repayment Source | Paid back from the future settlement or award | Paid back from the guaranteed settlement or award |

| Risk to Plaintiff | None. If you lose the case, you owe nothing. | None. Repayment is guaranteed by the settlement. |

Ultimately, the right choice is dictated by the status of your case. Each serves a distinct, vital purpose in a plaintiff’s financial journey.

Making the Right Choice for Your Situation

So, which one is for you? It really comes down to where you are in the legal process. If you’re still in the trenches fighting your case, pre-settlement funding gives you the staying power you need. If you’ve already crossed the finish line but are stuck waiting for your money, post-settlement funding is your key to unlocking it now.

At Mohr Marketing, we help plaintiffs navigate this decision every day. Our job is to connect you with our network of vetted funding partners who provide fair, transparent terms, whether you need support before or after your case is resolved.”

Complex cases, like those involving hundreds of plaintiffs, require even more careful thought. If you’re involved in that kind of litigation, you can learn more from our guide on what is mass tort litigation. By taking a hard look at your unique circumstances, we can help you find the funding solution that lines up perfectly with your financial needs and legal timeline.

Understanding How to Qualify for Legal Funding

Here’s one of the biggest myths we see: plaintiffs assume their bad credit or lack of a job will automatically get them denied for lawsuit funding. That couldn’t be further from the truth.

The reality? Your personal financial history is almost entirely irrelevant to the approval process.

Unlike a bank loan, where they pull your credit and scrutinize every penny of your income, a legal funding company is looking at one thing: the merits of your lawsuit. Think of them as an investor in your case. Their decision isn’t based on your ability to pay them back; it’s based on the odds your case will win.

This completely flips the script on what it takes to qualify. It opens a door to financial relief for people who are struggling the most, regardless of what their bank account looks like.

The True Metrics for Approval

So, if your personal finances don’t matter, what do funding companies care about? They perform a deep dive into the specifics of your legal claim. At Mohr Marketing, our partners have a clear checklist they use to decide if a case is a solid candidate for funding.

They’re essentially looking at three core elements:

- Clarity of Liability: How obvious is it that the other party is at fault? A case with rock-solid proof—like a police report from a rear-end collision—is a much stronger bet.

- Significant Damages: Funders need to see that your case involves substantial, documented damages. This means medical bills, lost wages, and pain and suffering that all add up to a significant potential settlement.

- Insurance Coverage: This is a big one. The defendant has to have enough insurance coverage to actually pay out the settlement. A slam-dunk case against someone with no insurance, unfortunately, isn’t a good candidate.

Ultimately, they’re just asking one question: Does this case have a high probability of winning a settlement large enough to cover the cash advance and all the fees?

The Non-Negotiable Role of Your Attorney

There’s one requirement that’s pretty much universal across the board: you must have a lawyer. Funding companies don’t work directly with plaintiffs. Their entire process relies on working closely with your attorney to get the documents and professional opinions they need.

Your lawyer is the one who provides the case files, medical records, and expert reports that the funder needs to make a decision. This partnership is what makes the whole thing work, verifying the claim’s details and keeping the process smooth. It’s why your very first step, before anything else, should be finding a skilled attorney.

The strength of your case is your most valuable asset. While traditional lenders look at your financial past, legal funders are focused on the future value of your lawsuit. This is what opens the door to financial relief when other options are closed.”

Having the right paperwork ready is crucial. While it’s focused on the commercial side, this guide on qualifying for business loans has some great universal tips about application readiness that can be conceptually helpful. With a strong case and a great lawyer by your side, you can confidently look at lawsuit funding as a way to take the financial pressure off.

Breaking Down the True Costs of Lawsuit Funding

When you’re looking into lawsuit funding, transparency isn’t just a buzzword—it’s everything. It’s so important to get your head around the fact that a cash advance on your settlement isn’t a typical loan with a standard interest rate. Understanding how the numbers really work is the only way to make a decision you won’t regret later.

Instead of charging interest, most funding companies use what are called funding fees or multipliers. These are designed to grow the total amount you owe them over time. You absolutely have to get how these fees are calculated, because it can make a massive difference in your final cost. This is why you must dig into the fine print before signing anything.

Simple vs. Compounding Rates

One of the first and most critical questions to ask any funder is whether their rates are simple or compounding. Honestly, the difference between these two is night and day, and it will directly impact how much of your settlement check actually ends up in your pocket.

- Simple Rates: This is the straightforward option. With a simple rate, the fee is calculated only on the original cash advance you received. It’s a fixed percentage that grows in a way you can easily predict. No surprises here.

- Compounding Rates: This is where things can get tricky—and expensive. A compounding rate is calculated on your original advance plus any fees that have already piled up. In other words, you’re paying fees on top of fees, which can make the total amount you owe spiral out of control.

At Mohr Marketing, we get how vital this distinction is. We only connect plaintiffs with our hand-picked network of partners who believe in clear, fair, and plaintiff-friendly terms. That usually means simple fee structures, so you can keep more of your hard-won settlement.

Choosing a funding partner with a transparent, simple fee structure isn’t a small detail—it can save you thousands of dollars. It protects you from nasty surprises and ensures the financial help you get today doesn’t turn into a huge headache tomorrow.”

It’s no secret this industry is booming. More and more, legal funding is being seen as a standard financial tool for plaintiffs. The litigation funding market was valued at around $16.8 billion in 2025, and some analysts expect it to grow at a CAGR of about 7.5% through 2034, potentially hitting $34.5 billion. As the market gets more crowded, it’s even more important for you to have an advocate who can cut through the noise and find you fair terms. You can dig into the numbers behind this growth in a recent market report.

A Practical Example of Funding Costs

Let’s walk through a real-world example to see just how much these different fee structures can affect your bottom line. Say you get a $10,000 cash advance for your personal injury case.

Here’s a breakdown of what your total repayment might look like under two different scenarios—one with a simple monthly rate and one with a compounding monthly rate.

| Time Elapsed | Repayment with Simple Rate (e.g., 3% per month) | Repayment with Compounding Rate (e.g., 3% per month) |

|---|---|---|

| After 12 Months | $13,600 | $14,258 |

| After 24 Months | $17,200 | $20,328 |

| After 36 Months | $20,800 | $28,983 |

The difference is staggering, isn’t it? And it just gets bigger over time. After three years, the compounding rate costs you over $8,000 more than the simple rate for the exact same $10,000 up front. This is precisely why you can’t afford to ignore the fee structure.

Mohr Marketing Connects You with Fair Terms

Trying to make sense of these financial details can feel like a full-time job, especially when you’re already swamped with the stress of a lawsuit. This is where Mohr Marketing comes in. We’re not a direct funder; think of us as your advocate.

We’ve spent years building an exclusive network of reputable funding partners who are committed to being transparent and putting plaintiffs first. We do the legwork for you, connecting you with funders who offer:

- Clear and Competitive Rates: We make sure you get offers with straightforward fee structures you can actually understand.

- No Hidden Fees: Our partners provide contracts that spell out every potential cost, so you won’t get hit with surprises down the road.

- Plaintiff-First Approach: We refuse to work with companies that don’t prioritize your financial well-being.

By leaning on our experience, you can steer clear of predatory companies and find a lawsuit funding option that gives you the support you need without eating away at your final settlement.

Choosing the Right Funding Partner with Mohr Marketing

Trying to navigate the world of lawsuit funding can feel like walking through a maze blindfolded. You’ve got dozens of companies all promising you the best deal, but how do you know who to trust? This is exactly where having the right advocate on your side can change everything, turning a confusing process into a clear path forward and protecting your financial future.

It’s important to be crystal clear about one thing: Mohr Marketing is not a direct funder. Instead, think of us as your dedicated representative. We connect you to an exclusive, pre-vetted network of top-tier funding partners. Our entire service is built to save you time, cut through the stress, and lock in the absolute best terms for your unique situation.

Your Advocate in a Crowded Market

The best way to picture what we do is to think of a mortgage broker, but for legal funding. A great broker doesn’t just find you any old loan. They shop the entire market, crunch the numbers on different offers, and use their industry connections to get you the lowest rates and best terms possible. That’s precisely the role we play in the lawsuit funding space.

Instead of you sinking countless hours into researching companies, filling out one application after another, and trying to make sense of dense, complicated contracts, we handle all that heavy lifting for you. We already know who the reputable players are and have built strong relationships with funders who meet our strict criteria for fairness and transparency.

This approach gives you a massive advantage right out of the gate. You get instant access to a handpicked selection of the industry’s best lawsuit funding options, without the guesswork or the risk of falling for a predatory lender.

The Mohr Marketing Advantage

When you work with us, you’re not just getting a referral. You’re getting a partner who is 100% committed to your best interests. We make sure every single funding option we bring to the table is clear, competitive, and designed to actually help—not hinder—your financial recovery.

Here are the core benefits of tapping into our network:

- Access to Competitive Rates: Because of our established relationships and the sheer volume of cases we handle, we can secure some of the most competitive rates on the market. That means you keep more of your settlement.

- Complete Transparency: We have a zero-tolerance policy for hidden fees or confusing jargon buried in the fine print. We only partner with funders who believe in total disclosure.

- Time and Stress Savings: We run the entire application and comparison process from start to finish. This frees you up to focus on what really matters: your health and winning your case.

- Vetted and Trusted Partners: Every single funder in our network has been put through the wringer. We’ve vetted them for their reputation, their financial stability, and their commitment to ethical practices.

Our process is built around one simple goal: matching you with a funder who not only gets the specifics of your case but also offers the best possible financial outcome for you. For attorneys, this streamlined approach can also be a massive benefit, which we break down in our guide on how to finance your clients for your services.

By acting as your advocate, Mohr Marketing transforms a potentially overwhelming search into a simple, secure, and effective process. We ensure you’re not just finding funding, but finding the right funding.

The lawsuit funding industry is exploding. In 2025, the global litigation funding investment market was estimated to be between USD 18 billion and USD 21 billion. Forecasts predict it will rocket past USD 67 billion by 2037. With that much money flooding the market, having an expert on your side is more critical than ever. You can dive into the data behind these projections and learn more about the key aspects of the litigation funding investment market.

Common Questions About Lawsuit Funding

When you’re exploring lawsuit funding, a lot of questions pop up. It’s totally normal. Our goal at Mohr Marketing is to cut through the noise and give you straight answers so you can make a decision you feel good about.

We’ve gathered the most common questions we hear from plaintiffs every single day. Let’s clear up the confusion and give you the clarity you need to move forward.

Is Lawsuit Funding Just Another Type of Loan?

This is the number one question we get, and the answer is a hard no. A loan is a debt you have to pay back, period. It doesn’t matter what happens with your finances or your case. Lawsuit funding is completely different—it’s what’s known as a non-recourse cash advance.

Think of it more like a company investing in the potential outcome of your case. If you win or settle, the funder gets a pre-agreed-upon piece of that award. But if you lose your case? You owe them absolutely nothing. Zero. The risk is all on the funding company, not you.

This is the key difference, and it’s designed to protect you. It guarantees you won’t be stuck with more debt if your legal fight doesn’t go your way. The partners in Mohr Marketing’s network specialize exclusively in this kind of plaintiff-friendly, non-recourse funding.

How Long Does the Approval Process Take?

When you’re under financial pressure, time is everything. Waiting weeks or months for an answer just isn’t an option. The good news is that the approval process for lawsuit funding is incredibly fast, especially compared to any traditional bank loan.

Once you apply and give us the green light to speak with your attorney, things move quickly. Our funding partners will request the necessary case documents from your lawyer to see how strong your claim is. In many cases, you can have a decision and cash in your account within 24 to 48 hours after they receive all the paperwork.

At Mohr Marketing, we’ve streamlined this whole process. We connect you with our pre-vetted network of partners who are known for their speed, cutting out the delays to get you the money you need, fast.

What Happens if My Settlement Is Less Than Expected?

That’s a smart question and a very real concern for a lot of plaintiffs. What if the final settlement isn’t the home run everyone was hoping for? With a non-recourse advance, you’re still protected. The repayment amount can never exceed your actual settlement award.

You will never, ever have to pay a single dollar out of your own pocket. The funding company is only paid from the money you win. If the final award is smaller than anticipated, their recovery is capped at that amount, making sure you’re never left in a worse financial spot. This is a core feature of the lawsuit funding we help arrange.

Can I Get More Funding if My Case Gets Delayed?

Yes, that’s often an option. Lawsuits are unpredictable. Unexpected delays can drag things out and stretch your finances to the breaking point. If your case is taking longer than planned and you need more help, you can usually apply for another cash advance.

The process is pretty much the same as your first application. The funding company will take another look at your case, consider any new developments, and evaluate the remaining estimated value of your settlement. If you’re approved, you can get a second round of funding to see you through. Mohr Marketing is here to help you navigate this, reconnecting you with our partners to get the extra support you need to finish the fight.

Ready to find a lawsuit funding option that gives you financial stability and peace of mind? Mohr Marketing LLC connects you with our exclusive network of trusted, transparent funding partners to secure the best possible terms for your case. Let us be your advocate.

Learn more and get started today at https://www.mohrmktg.com.

At Mohr Marketing, our core benefit is providing law firms with a predictable, scalable, and high-quality stream of signed cases. This allows our partners to build powerful dockets, maximize their impact, and focus on what they do best: winning for their clients. Visit https://www.mohrmktg.com to see how we help firms champion their clients’ rights.

Book your free, no-obligation strategy call today:

https://calendly.com/mohrmarketing

Let’s discuss your specific needs and how our signed cases and verified leads can help you achieve your growth goals.

We are also generating Spanish-speaking leads.

For more information, check out our website:

Best Wishes,

Sue Mohr

Recent Posts

- Scalable MVA Case Acquisition: AI-Driven Police Report Strategies

- The Gold Standard in MVA Case Acquisition

- The GLP-1 Litigation Landscape has Shifted

Categories

- AI and Lead Generation

- Business Financing

- Call Verified MVA Leads

- Car Accident Help

- Car Accident Settlements

- Claimant Funding

- Compliance Program

- Geotargeting

- Google Maps Ranking

- Healthcare Practice Growth

- Law Firm Growth

- Law Office Operations

- Lead Generation

- Lead Generation For Attorneys

- Lead Generation For Chiropractors

- Lead Generation For Criminal Attorneys

- Lead Generation For D&A Treatment Centers

- Lead Generation For DUI Attorneys

- Lead Generation For Eye Doctors

- Lead Generation For Family Law Practices

- Lead Generation For PI Law Firms

- Lead Generation For Plastic Surgeons

- Leads For Healthcare Professionals

- Leads For Insurance Industry

- Legal Leads

- Legal Marketing

- Legal Updates

- Mass Tort Leads

- Medicare and Medicaid Leads

- Merchant Funding Leads

- Online Marketing Strategies

- Pre-Settlement Funding

- Signed MVA Cases

- Tort Updates

- Truck Accident Settlements

- Web Design

Archives

Copyright © 1994-2025 Mohr Marketing, LLC. All Rights Reserved.