Navigating the Personal Injury Settlement Timeline

September 30, 2025 by Susan Mohr

Understanding the Path to Your Settlement

After you’ve been injured, one of the first things you probably want to know is, “How long is this going to take?” It’s a fair question, and while there’s no single answer, a typical personal injury settlement can take anywhere from a few months to more than a year.

It’s a process, not a race. Straightforward cases can wrap up relatively quickly, but more complex situations will naturally take longer. The key is understanding the journey ahead.

Trying to figure out a personal injury claim can feel like you’ve been handed a ticket for a long trip but no map to follow. You know where you want to end up—with a fair settlement—but the route is unclear. There are distinct stages, potential detours, and necessary stops along the way.

Without an experienced guide, it’s easy to take a wrong turn that adds months, or even years, to your timeline. This is where having a dedicated partner changes everything. Mohr Marketing provides the critical advantage by connecting you with legal professionals who know this terrain inside and out. They act as your expert navigator, ensuring every step is handled strategically to get you from the initial incident to a final resolution.

The Journey Analogy

Think of the settlement timeline like planning a cross-country road trip. You wouldn’t just hop in the car and start driving. First, you’d map your route (that’s your initial consultation), pack everything you need (gathering evidence), and try to anticipate roadblocks like rush hour traffic or bad weather (which are a lot like insurance company tactics).

- Your Destination: A Fair Settlement That Covers Your Recovery.

- Your Vehicle: A Strong, Well-Documented Legal Case.

- Your Navigator: An experienced legal team, like those in the Mohr Marketing network, that knows the shortcuts and how to handle delays.

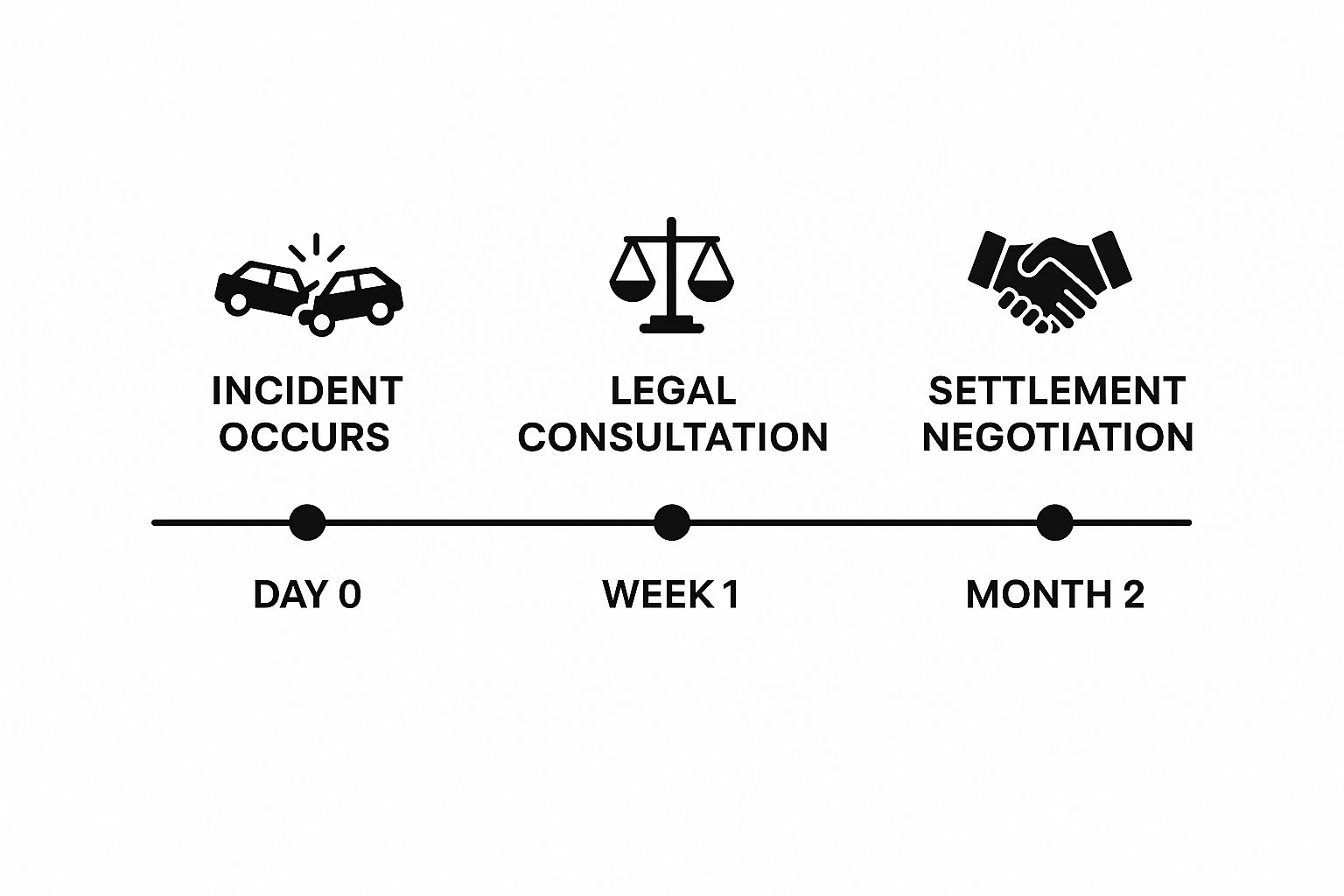

This infographic gives you a bird’s-eye view of the first few milestones you’ll encounter on your journey.

As you can see, the process kicks off right away, but some of the most critical stages, like negotiations, might not even begin for a couple of months.

Estimated Settlement Timelines by Injury Severity

To give you a clearer idea, here’s a quick look at how the complexity of your case can impact the timeline.

| Case Complexity | Average Settlement Timeline |

|---|---|

| Minor Injuries | 3-9 months |

| Moderate Injuries | 9-18 months |

| Severe or Catastrophic Injuries | 18 months to several years |

Remember, these are just estimates. A case with minor injuries but complicated liability could take longer than a more severe case where fault is clear.

Knowing the sequence of events is the first step toward managing your expectations and feeling more in control. For a more in-depth look at what each step entails, you can explore our detailed guide on the personal injury claim process.

Ultimately, a knowledgeable legal team—the kind Mohr Marketing connects you with—ensures your journey is as smooth as possible. They keep you informed at every turn and work to ensure you arrive at your destination without unnecessary delays.

The Critical First Steps After Your Injury

The moments right after an accident are a blur of chaos and adrenaline. It’s overwhelming. However, the choices you make in these first few hours and days lay the groundwork for your entire personal injury claim.

Getting this part right isn’t just a good idea—it’s absolutely essential if you want a smooth and successful settlement journey down the road.

Think about it like building a house. You can’t start putting up walls on shaky ground. These initial steps—getting medical care, documenting everything, and filing a report—are the concrete foundation. If that foundation is weak, the whole structure of your case can collapse later on.

This is exactly why having an experienced team in your corner from day one makes all the difference. Mohr Marketing offers a direct connection to legal professionals who recognize that a strong start has a significant impact on the personal injury settlement timeline. They help you sidestep the common pitfalls that insurance companies love to use to delay or deny claims.

Prioritize Your Health and Medical Documentation

Your top priority, no matter what, is your well-being. Seek medical attention immediately after an accident, even if you feel fine. Some of the most serious injuries, like internal bleeding or concussions, don’t show symptoms immediately.

Putting off a doctor’s visit is like handing the insurance adjuster a gift. It gives them an easy excuse to argue that your injuries weren’t actually caused by the accident. Getting immediate medical documentation, including advanced imaging when necessary, is vital for your claim. This guide to teleradiology services for injury documentation offers more technical insight for those interested.

Every single doctor’s visit, test, and treatment creates an official record, building a direct line between your injuries and the incident. This paper trail becomes one of the most powerful pieces of evidence you have.

Document Everything at the Scene

If you’re physically able, the next critical move is to become a detective at the scene. Your memory will fade, but a photo is forever. Use your smartphone and capture everything you can from every possible angle.

Here’s what to focus on:

- Vehicle Damage: Snap pictures of all cars involved. Get close-ups of the damage and wide shots showing where the vehicles ended up.

- Your Injuries: Take photos of any visible cuts, bruises, or swelling as soon as you can.

- The Surrounding Area: Capture the road conditions, traffic lights, skid marks, weather—anything that might have played a role.

- Witness Information: Politely get the names and phone numbers of anyone who saw what happened. Their account could be invaluable.

The evidence you gather in the first hour can be more powerful than anything collected over the next six months. It’s the raw, unfiltered story of what happened before memories get fuzzy or the scene is cleared.”

Official Reporting and Legal Guidance

Last but not least, always get an official report. If you were in a car crash, call the police. If you slip and fall in a store, report it to the manager and ensure they file an incident report. This document is the first official marker of your claim.

Trying to manage all this on your own while you’re hurt and shaken is a tall order. A key benefit of working with Mohr Marketing is having expert guidance right from the beginning. By building this solid foundation the right way, you set your case up for a much smoother path to a fair resolution and avoid the delays that can derail an otherwise strong claim.

Building a Case Your Opponent Cannot Ignore

After the initial flurry of activity, your personal injury settlement timeline settles into its longest, most critical phase: building your case. This isn’t a race. It’s more like a meticulous construction project, where every piece of evidence is a brick, and the goal is to build a fortress so strong the insurance company has no choice but to take you seriously.

This is the stage where claims either gain unstoppable momentum or simply fall apart. A case thrown together in a hurry is like a house of cards; it might look okay at first glance, but it will crumble under the slightest pressure from the other side.

That’s why the right approach is everything. Mohr Marketing connects you with legal professionals who get it—winning a fair settlement isn’t about speed, it’s about strength. Their strategic and exhaustive approach during this phase ensures every angle is covered. That thoroughness is what gives you a powerful negotiating position down the road.

Gathering the Essential Documentation

The bedrock of any solid personal injury claim is official documentation. These are the records that lay out the cold, hard facts—facts that insurance adjusters can’t easily argue away. It’s a painstaking process of formally requesting, collecting, and organizing what can feel like a mountain of paperwork.

The legal teams we connect you with are relentless in tracking down every necessary document. This includes:

- Complete Medical Records: We’re talking about more than just the first ER visit. This covers every single doctor’s appointment, physical therapy session, specialist consult, prescription, and medical test.

- Official Police and Incident Reports: The official narrative from law enforcement or the property owner is crucial for establishing the basic facts right from the start.

- Wage and Employment Information: They get official statements from your employer to document exactly how much income you’ve lost and how this injury could impact your ability to earn a living in the future.

This paper trail creates an undeniable timeline of your injuries and their financial consequences, leaving very little room for the defense to challenge your story.

Calculating the Full Scope of Your Damages

One of the biggest pitfalls in a personal injury claim is failing to grasp the full extent of your damages. It’s natural to focus on the immediate medical bills piling up, but a truly fair settlement has to account for all your losses—past, present, and even future.

At Mohr Marketing, we ensure your legal team performs a deep dive to calculate the real value of your claim. Understanding the importance of comprehensive evidence is central to this process, as it forms the very foundation of what you’re fighting for. This isn’t just about adding up receipts; it’s a complex valuation of how this injury has turned your entire life upside down.

A strong case quantifies not just the economic costs, but the human costs as well. It tells the story of your pain, your struggle, and the life you’ve lost, turning abstract suffering into a concrete number the insurance company must address.”

This means fighting for compensation that covers everything:

- All Medical Expenses: Including any future surgeries or long-term care you might need.

- Lost Income and Earning Potential: Especially if your injuries mean you can’t go back to your old job.

- Pain and Suffering: For the physical agony and emotional distress you’ve been forced to endure.

- Loss of Enjoyment of Life: Compensation for the hobbies, activities, and simple joys you can no longer take part in.

Leveraging Expert Testimony

Sometimes, the paperwork alone doesn’t paint the full picture. For more complex cases, you need experts who can break down the technical details for an insurance adjuster or a jury. Bringing in an expert witness is a power move that shows the other side you’re prepared for anything.

The attorneys in the Mohr Marketing network have access to respected professionals ready to provide that critical analysis. This might include:

- Medical Experts who can explain the severity of your injuries and what your long-term prognosis really looks like.

- Accident Reconstructionists who use physics and engineering to prove exactly how the incident happened.

- Economic Experts who can calculate the total financial blow of your injuries on your lifetime earnings.

Having experts in your corner sends a clear message: you have the resources and the determination to see this through. That alone is often enough to bring a much fairer settlement offer to the table. For a deeper look at how liability is established in these cases, check out our guide on determining fault in an accident.

The Art of Negotiation and Securing a Fair Offer

After months of building your case piece by piece, the timeline shifts into its most critical phase: negotiation. This is where all that hard work gets put to the test. Forget the courtroom theatrics you see on TV; think of this as a high-stakes chess match where every single move is calculated.

The first move is sending a formal demand letter. This isn’t just a bill—it’s a comprehensive, powerful document that tells the complete story of your case. It lays out the facts, details the true extent of your injuries, and presents a clear, justified calculation of the damages you’ve suffered. This letter is your opening gambit, and it sets the tone for everything that comes next.

The Strategic Dance of Offers and Counteroffers

Once the insurance company receives the demand letter, its adjuster will review everything and return with an initial settlement offer. Brace yourself. This first offer is almost always a lowball, designed to determine if you’re desperate enough to accept a quick, low payout.

This is where the benefit of Mohr Marketing truly shines. We connect you with seasoned negotiators who spot these lowball tactics from a mile away. They’ll break down the offer, explain exactly why it’s not enough, and counter with a strategic offer backed by the very evidence they spent months gathering. This back-and-forth can go on for several rounds, and it requires both patience and unwavering persistence.

An experienced negotiator doesn’t just argue facts; they leverage them. They know which pieces of evidence—a specific medical report, an expert’s opinion, a key witness statement—will apply the most pressure and force the adjuster to reassess their position.”

The goal here is to show you won’t be intimidated or rushed. By systematically rejecting bad offers and justifying every counteroffer with solid proof, your legal team builds pressure. They make it crystal clear that settling fairly is the insurance company’s best and only real option.

Countering Common Insurance Adjuster Tactics

Insurance adjusters are pros whose job is to protect their company’s bottom line by paying out as little as possible. They have a whole playbook of strategies to make that happen, but a prepared legal team knows how to shut them down.

Here are a few common tactics and how a sharp negotiator responds:

- Delaying the Process: They might take weeks to respond, hoping you’ll get frustrated and accept less. The Counter: A proactive legal team sets firm deadlines and follows up relentlessly. They keep the pressure on and the case moving forward.

- Disputing Liability: Even with clear proof, they might try to shift some of the blame onto you to lower the payout. The Counter: Your attorney will use police reports, witness testimony, and accident reconstruction data to dismantle these arguments before they gain any traction.

- Downplaying Injuries: They may argue your injuries aren’t as bad as the medical records show, or that they were pre-existing conditions. The Counter: This is where expert medical testimony and a complete treatment history become your ace in the hole, proving the direct link between the incident and your current condition.

Navigating these tactics is where having Mohr Marketing on your side gives you a clear and undeniable edge. We connect you with a legal advocate who won’t just react to the insurance company’s moves—they’ll anticipate them, control the narrative, and fight for the full compensation you are owed. This expert negotiation is often what separates a paltry offer from a truly fair settlement, helping you resolve your case without the added time and stress of a trial.

Knowing the financial possibilities is also key. Settlement amounts vary wildly, but the overall average is around $40,500. The range is huge, though, from $10,000 for simpler cases to over $1 million for catastrophic injuries. For a more detailed look, you can explore personal injury settlement examples.

What Happens When Your Case Goes to Court

While most personal injury cases get hammered out during negotiations, sometimes you hit a wall. If the insurance company simply refuses to make a fair offer, filing a lawsuit is the only move left. This decision officially takes your case from the negotiation table and throws it into the formal legal system—a process called litigation.

Stepping into the litigation phase can feel like a huge, intimidating leap. But honestly? It’s often the most powerful tool you have to make a stubborn insurance adjuster finally take your claim seriously. It sends a clear signal that you’re not backing down and are fully prepared to argue your case in front of a judge and jury. Just the act of filing the lawsuit can completely shift the dynamic and kickstart productive settlement talks again.

At Mohr Marketing, we understand this strategic advantage. We connect you with legal pros who aren’t afraid of a courtroom battle. Their readiness to go to trial is a massive asset; this meticulous preparation often convinces the other side to come back with a much stronger offer just to avoid facing them in court.

The Discovery Phase: Laying All the Cards on the Table

Once a lawsuit is filed, your personal injury settlement timeline enters what’s known as the discovery phase. You can think of this as a mandatory “show your cards” moment for everyone involved. It’s a formal process where your legal team and the opposing lawyers exchange every shred of information and evidence related to the case.

The entire point is to eliminate surprises down the road and make sure both sides have the exact same picture of the facts. This transparent exchange is fundamental to our legal process and involves a few key steps.

Here’s what typically happens during discovery:

- Interrogatories: These are just written questions one side sends to the other. The answers have to be given under oath.

- Requests for Production: This is where each side requests documents, photographs, videos, and any other physical evidence from the opposing party.

- Requests for Admission: These are written statements in which one side asks the other to either admit or deny. It helps narrow down what’s actually in dispute.

This part of the process can drag on, often lasting several months, because it’s an incredibly thorough deep-dive into every single aspect of your claim.

Depositions and Pre-Trial Maneuvers

A huge part of discovery is the deposition. This is where witnesses—including you and the defendant—give formal testimony out of court, answering questions from the opposing attorneys while under oath. A court reporter is responsible for transcribing every word, creating an official record that can be used later in court.

Depositions provide lawyers with a preview of how a witness will perform on the stand and help them solidify their story. A strong, consistent performance during your deposition can significantly increase your leverage when settlement talks resume.

After discovery wraps up, both sides might start filing pre-trial motions. These are basically legal requests asking the court to rule on specific issues before the trial even starts. For instance, a lawyer might file a motion to exclude certain evidence from the trial, or even request a summary judgment from the judge to resolve the case without requiring a full trial.

Going to court definitely adds a new layer to your settlement timeline, but it also massively cranks up your negotiating power. It’s a strategic play that forces the other side to weigh the risk and expense of a trial against the cost of giving you a fair settlement.”

It’s critical to understand that filing a lawsuit will extend your timeline, no question about it. The timeline for personal injury settlements already varies wildly depending on how badly you were hurt. For example, less severe injuries like cuts might settle in 10 to 13.5 months, while a complex spinal cord injury can easily take 27 to 36 months. Litigation can tack on another year or more to those estimates. You can see how different injuries affect these timelines by checking out updated data on personal injury cases.

Still, that extra time is often an investment worth making. The hard work and diligent trial prep done by the legal professionals Mohr Marketing partners with is a powerful motivator for the opposition to finally come to the table with the fair settlement you’ve deserved from the very beginning.

Finalizing Your Settlement and Receiving Payment

Finally reaching a settlement agreement feels like a massive weight has been lifted. It’s the moment you’ve been fighting for, but it’s not quite the finish line. Before you see any money, there are a few critical administrative steps left to handle.

This last phase is all about the details—paperwork, processing, and patience. At Mohr Marketing, we provide access to legal professionals who navigate this final stage with absolute efficiency and transparency. Our partners prioritize a smooth, clear conclusion to your case, so you can officially close this chapter and get back to your life.

Signing the Release and Receiving the Funds

After you’ve verbally agreed to a settlement amount, the insurance company gets to work drafting a formal settlement agreement and release form. Think of this as the official, binding contract where you agree to end your claim in exchange for that payment. By signing it, you’re confirming you won’t pursue any more legal action against the at-fault party for this specific incident.

Of course, your legal team will comb through this document with a fine-tooth comb, making sure every term is correct and your interests are fully protected. Once you’ve signed and sent it back, the insurance company processes everything and cuts the check, which is typically mailed directly to your attorney’s office.

The time between signing that release and the check arriving can feel like an eternity, but this is where a little patience goes a long way. Behind the scenes, your legal team is making sure everything is handled by the book and holding the insurer accountable to their end of the bargain.”

How the Settlement Money Is Distributed

When the settlement check finally arrives at the law firm, it doesn’t go straight into your bank account. Instead, it’s deposited into a special, highly regulated trust account. This is a standard practice designed to make sure all outstanding financial obligations tied to your case are settled first.

Here’s a look at how those funds are typically allocated:

- Legal Fees: The first item paid is your attorney’s contingency fee. This is the pre-agreed-upon percentage of the settlement you discussed when you hired them.

- Case Expenses: Next up are any costs the law firm advanced to build your case. This could include things like court filing fees, the cost of hiring expert witnesses, or charges for obtaining medical records.

- Medical Liens: Finally, any outstanding medical bills or liens from hospitals and other healthcare providers are paid off directly from the settlement. This is a crucial step to make sure your medical debts are officially cleared.

After every one of these obligations has been satisfied, what’s left is your net settlement. Your attorney will then issue a check for this final amount directly to you. For anyone feeling the financial pinch while their case is ongoing, understanding options like pre-settlement funding can offer some much-needed relief while you wait for this final payment to come through.

Of course. Here is the rewritten section, crafted to sound natural and human-written, following the style of your provided examples.

Got Questions? Let’s Talk About Your Settlement Timeline

When you’re in the middle of a personal injury claim, the timeline can feel like a complete mystery. It’s totally normal to have questions. Getting straight answers helps you know what to expect and gives you a much clearer picture of the road ahead. We’ve pulled together the questions we hear all the time and answered them in plain English.

Having the right legal partner in your corner is the key to navigating all of this. Mohr Marketing connects you with seasoned professionals who offer clear, direct guidance. You’ll never be left wondering about the progress of your case or the game plan for protecting your interests.

Can I Do Anything to Speed Up My Settlement?

Yes and no. While some parts of the process are just going to take time, you can absolutely help keep your case from hitting unnecessary speed bumps. The best thing you can do? Be incredibly responsive and organized. When your legal team requests documents, provide them promptly. Be 100% upfront about the details of your case and, most importantly, follow your doctor’s orders.

But the biggest factor in keeping things moving is having an expert team driving the process. The legal pros Mohr Marketing partners with are masters of efficiency. They don’t just react; they anticipate the insurance company’s next move, manage deadlines proactively, and handle negotiations with a skill that prevents the frustrating delays that can stall a case.

Why Is the Insurance Company Dragging Its Feet?

It’s a classic, and infuriating, tactic. Insurance companies often intentionally slow down claims. They’re hoping the financial pressure and mounting stress will wear you down until you cave and accept a lowball offer. You might find them asking for the same information repeatedly or questioning facts that are clearly documented.

This isn’t a sign that your case is weak—it’s a calculated strategy. The best way to fight back is with a strong offense, led by a lawyer who sees these delay tactics for what they are and refuses to play their game.”

A sharp attorney will shut this down by setting firm deadlines, presenting meticulously organized evidence, and making it clear they are ready and willing to go to court. This proactive approach—a signature of the teams Mohr Marketing works with—sends a powerful message to the insurer: you will not be bullied.

Will I Have to Pay Taxes on My Settlement?

This is a big financial question, and the answer is usually good news. According to the IRS, the money you get for your physical injuries and medical bills is not considered taxable income. This rule covers the part of your settlement that’s meant to compensate you for your losses after an accident.

But there are a few exceptions. If a portion of your settlement is for something else, like lost wages or punitive damages, that part might be taxable. Since every situation is different, it’s always a smart move to chat with a financial professional who can explain the specific tax implications for your settlement.

Navigating the twists and turns of a personal injury claim demands a partner you can trust. Mohr Marketing connects you with the legal pros you need to secure a fair outcome without getting bogged down in delays. Visit us at https://www.mohrmktg.com to see how we empower legal professionals to win for their clients.

Let’s discuss your specific needs and how our AI-powered lead Generation, digital marketing, signed cases, and verified leads can help you achieve your growth goals.

We are also generating Spanish-speaking leads.

For more information, check out our website:

Best Wishes,

Sue Mohr

Recent Posts

- AI-Driven, Criteria-Specific, & Fully Compliant

- Is Your Lead Vendor Costing You Your Law License?

- No “Shared” Leads. No “Call Transfers.” No Dirty Data.

Categories

- AI and Lead Generation

- Business Financing

- Call Verified MVA Leads

- Car Accident Help

- Car Accident Settlements

- Claimant Funding

- Compliance Program

- Geotargeting

- Google Maps Ranking

- Healthcare Practice Growth

- Law Firm Growth

- Law Office Operations

- Lead Generation

- Lead Generation For Attorneys

- Lead Generation For Chiropractors

- Lead Generation For Criminal Attorneys

- Lead Generation For D&A Treatment Centers

- Lead Generation For DUI Attorneys

- Lead Generation For Eye Doctors

- Lead Generation For Family Law Practices

- Lead Generation For PI Law Firms

- Lead Generation For Plastic Surgeons

- Leads For Healthcare Professionals

- Leads For Insurance Industry

- Legal Leads

- Legal Marketing

- Legal Updates

- Mass Tort Leads

- Medicare and Medicaid Leads

- Merchant Funding Leads

- Online Marketing Strategies

- Pre-Settlement Funding

- Signed MVA Cases

- Tort Updates

- Truck Accident Settlements

- Web Design

Archives

Copyright © 1994-2025 Mohr Marketing, LLC. All Rights Reserved.