Your Guide to a Rear End Collision Settlement

September 11, 2025 by Susan Mohr

Your First Steps After a Rear End Collision

What you do in the moments right after a rear-end collision has a massive impact on your final settlement amount. Seriously. The steps you take—from calling a doctor to snapping photos—build the foundation for your entire claim.

These first few actions are what separate a fair settlement from a lowball offer. They provide the hard evidence needed to prove who was at fault and exactly what you’ve lost.

It’s chaotic. It’s disorienting. But what you do at the scene and in the following days can make or break your case. Protecting your rights starts immediately, and being methodical is your best defense against insurance adjusters who are trained to minimize your payout.

Think of it this way: every photo you take, every note you make, helps tell the true story of the other driver’s negligence and your damages. The crash scene is a goldmine of evidence, but it disappears fast. Capturing it is non-negotiable if you want the compensation you deserve.

Seek Immediate Medical Attention

Before doing anything else, consider your health. Even if you feel perfectly fine, it’s a good idea to see a doctor. Adrenaline is a powerful chemical that can easily mask serious injuries like whiplash or even internal damage. Symptoms may not appear for hours or even days.

If you wait, you give the insurance company an easy excuse to argue your injuries aren’t from the crash. An immediate medical report creates a direct, undeniable link between the collision and your physical harm. That link is the cornerstone of any successful rear-end collision settlement.

Document Everything at the Scene

If you’re not seriously injured, switch into investigator mode. Gather as much information as you possibly can before you leave. This evidence is absolutely vital for proving fault and demonstrating the severity of the impact.

Your on-the-scene checklist should include:

- Photographs and Videos: Get pictures of both cars from every angle. Capture the damage up close, the license plates, and where the cars ended up. Don’t forget to snap photos of skid marks, debris on the road, or any traffic signs nearby.

- Driver and Witness Information: Swap the basics with the other driver, including name, phone number, driver’s license number, and insurance policy details. If anyone saw what happened, get their name and number. An impartial witness account can be incredibly powerful.

- Official Police Report: Always, always call the police. The official accident report they create is a formal record of the incident. It often includes the officer’s initial thoughts on who was at fault, which can be a huge help.

By meticulously collecting this evidence, you aren’t just taking notes. You’re building the entire framework for your legal claim. Every photo and witness statement makes your position stronger when it’s time to negotiate.”

This proactive approach means that when you partner with an expert legal team, like the ones Mohr Marketing connects you with, they have solid evidence to fight for you from day one. Doing this groundwork gives them the ammunition they need to secure the full and fair settlement you’re entitled to.

What Determines Your Settlement Amount

Here’s the thing about a rear-end collision settlement: no two are ever alike. The final number isn’t just pulled from a hat. It’s a carefully calculated figure that hinges on a very specific set of variables. The first step toward getting what you’re owed is understanding exactly what those variables are.

Think of your claim as the complete story of your losses. Every single piece of evidence, from a doctor’s report to a missed pay stub, is a new chapter that adds critical context and value. Insurance companies and legal teams will pore over this story to figure out what your case is truly worth.

Key Factors That Shape Your Settlement Value

The journey from accident to settlement involves a detailed assessment of multiple factors. Each piece contributes to the final calculation, painting a full picture of the accident’s impact on your life.

Below is a breakdown of the critical elements that can affect your final compensation.

| Influencing Factor | Impact on Settlement Value | Example |

|---|---|---|

| Severity of Injuries | High Impact – The more severe and long-lasting the injuries, the higher the settlement. This is the single biggest driver of value. | A minor whiplash case might settle for $10,000, while a case requiring spinal fusion surgery could exceed $1,000,000. |

| Total Medical Bills | High Impact – All past, present, and future medical costs are tallied. Higher bills directly translate to a higher economic damage claim. | Emergency room visits, physical therapy, surgeries, prescriptions, and ongoing chiropractic care. |

| Lost Income | Medium to High Impact – Covers wages lost while recovering. If you can’t return to your old job, this includes future lost earning capacity. | Missing two months of work at a $5,000 monthly salary results in a $10,000 increase to the claim. |

| Property Damage | Low to Medium Impact – The cost to repair or replace your vehicle and any damaged personal items inside. | Cost of vehicle repairs, plus replacement value for a damaged laptop or child car seat. |

| Pain and Suffering | High Impact – Compensation for physical pain, emotional distress, and loss of enjoyment of life. This is subjective but critical. | Chronic pain that prevents you from playing with your kids or enjoying a favorite hobby. |

| Policy Limits | High Impact – The settlement is capped by the at-fault driver’s insurance policy limits, unless you pursue their personal assets. | If the driver has a $50,000 policy limit, your insurance payout won’t exceed that amount. |

| Shared Fault | Medium to High Impact – If you are found partially at fault (e.g., your brake lights were out), your settlement can be reduced by your percentage of fault. | Being found 10% at fault for the accident would reduce a $100,000 settlement to $90,000. |

Understanding these components is crucial. An experienced attorney knows how to document and argue each point to build the strongest case possible, ensuring no detail is overlooked.

Quantifying Your Economic Damages

The most straightforward part of any settlement calculation involves your economic damages. These are the clear, tangible, out-of-pocket expenses that you can prove with a paper trail—receipts, bills, and official records.

Every penny you’ve had to spend or have lost because of the crash gets tallied up here.

- Medical Expenses: This covers it all. The initial ambulance ride, the ER visit, surgeries, physical therapy, prescription drugs, and even any medical care you’ll need down the road.

- Lost Wages: If your injuries kept you out of work, you’re entitled to every dollar of income you lost. This also includes any impact on your long-term earning power if you can no longer perform your job at the same level.

- Property Damage: This primarily refers to the cost of repairing or replacing your car. However, it also covers personal items that were damaged in the crash, such as a laptop, phone, or car seat.

Keeping meticulous records of these losses is non-negotiable. It creates a powerful, fact-based foundation for your claim that leaves very little room for an insurance adjuster to argue with the numbers.

Valuing Your Non-Economic Damages

This is where things get more complex. Non-economic damages are just as important, but they don’t come with a neat price tag. They represent the very real human cost of the collision—the pain, the stress, and the disruption to your life.

A fair settlement has to account for the physical and emotional toll of the accident. This includes pain and suffering, emotional distress, and the loss of enjoyment you experience in your day-to-day life.”

For example, if a back injury from the crash means you can’t pick up your kids or go for a run, that’s a tremendous loss with real value. While it’s subjective, this is a critical piece of any fair rear-end collision settlement.

Proving these damages often relies on detailed medical notes, a personal journal documenting your struggles, and even statements from friends and family. The more severe the injury, the higher this figure will be.

Other Critical Influencing Factors

Beyond damages, a few other elements can swing your final settlement amount one way or the other. One of the biggest is the at-fault driver’s insurance coverage. That’s why a solid understanding your auto insurance policy is so beneficial—it helps you know what to expect.

Another key factor is comparative negligence. In some states, if you’re found even partially to blame for the crash, your settlement can be reduced by that percentage. This is why having an expert prove the other driver was 100% at fault is so vital. It’s also crucial to know that not every accident leads to a payout; you can learn more about why not all MVA cases are compensable in our detailed guide.

Getting a Handle on Average Settlement Payouts

After an accident, everyone wants to know: What’s my case worth? Many people search for a magic “settlement calculator” in the hope of getting a quick answer. The truth is, no such thing exists. Every single case is different.

But that doesn’t mean you’re completely in the dark. Examining real-world data is the next best alternative. It helps you set realistic expectations and gives you a solid frame of reference for what your own rear-end collision settlement could look like.

Think of it like selling a house. Before you set a price, you’d look at what similar homes in your neighborhood have sold for. You’re not looking for an identical match, but for a realistic range. It’s the same with accident claims. By looking at typical payouts for different types of injuries, you get a much clearer picture of what’s fair.

Setting a Realistic Baseline for Your Claim

When it comes down to it, the value of a settlement is almost always tied directly to how badly you were hurt. It’s a simple but critical concept. A minor fender-bender that leaves you sore for a couple of weeks is going to be in a completely different ballpark than a high-speed crash that results in a permanent disability.

Breaking down settlements by injury level helps pull back the curtain on the valuation process. While your situation has its own unique details, these general categories give you a framework for what to expect. This context is absolutely crucial when you’re talking with your lawyer or pushing back against a lowball offer from an insurance adjuster.

Typical Settlement Ranges by Injury Severity

Most settlements fall into a few broad categories, based on the level of physical harm and the type of medical care required. This is precisely why having a clear diagnosis and detailed medical records is non-negotiable.

- Minor Injuries (Soft Tissue Damage): This is the most common category, encompassing injuries such as whiplash, muscle strains, and sprains. They’re painful, no doubt, but they usually improve with treatments such as physical therapy or chiropractic care. Settlements here tend to be on the lower end, designed to cover your medical bills, some lost pay, and a modest amount for your pain and suffering.

- Moderate Injuries (Herniated Discs, Fractures): When the injuries are more significant—think a herniated disc, a broken bone, or a concussion—the settlement value jumps up. These conditions require more serious medical intervention, longer recovery periods, and have a much bigger impact on your day-to-day life.

- Severe Injuries (Requiring Surgery or Causing Permanent Impairment): Cases involving surgery, serious nerve damage, traumatic brain injuries (TBIs), or any kind of permanent disability will command the highest settlement values. The compensation must account for a potential lifetime of medical needs, a permanent loss of earning capacity, and the profound impact on your quality of life.

This is where an experienced legal partner makes all the difference. The firms in the Mohr Marketing network know how to document the full, long-term consequences of your injuries. They bring in medical and financial experts to build an ironclad case that justifies a top-tier settlement, ensuring your future is secure.”

Data from all over the country support this. Take Texas, for example. The numbers for rear-end collision settlements tell a clear story. Minor injuries, such as sprains, often result in payouts averaging around $20,000. But for moderate injuries like herniated discs or fractures, the average settlement climbs to about $45,596. You can find out more about Texas car accident settlement data to see these patterns for yourself.

This is exactly why having undeniable proof of your injuries is so critical. A top-tier legal team, like those connected through Mohr Marketing, will make sure your medical records, MRIs, and expert reports tell a powerful and convincing story. They won’t let the insurance company downplay your pain, and they’ll fight to get you the compensation you truly deserve.

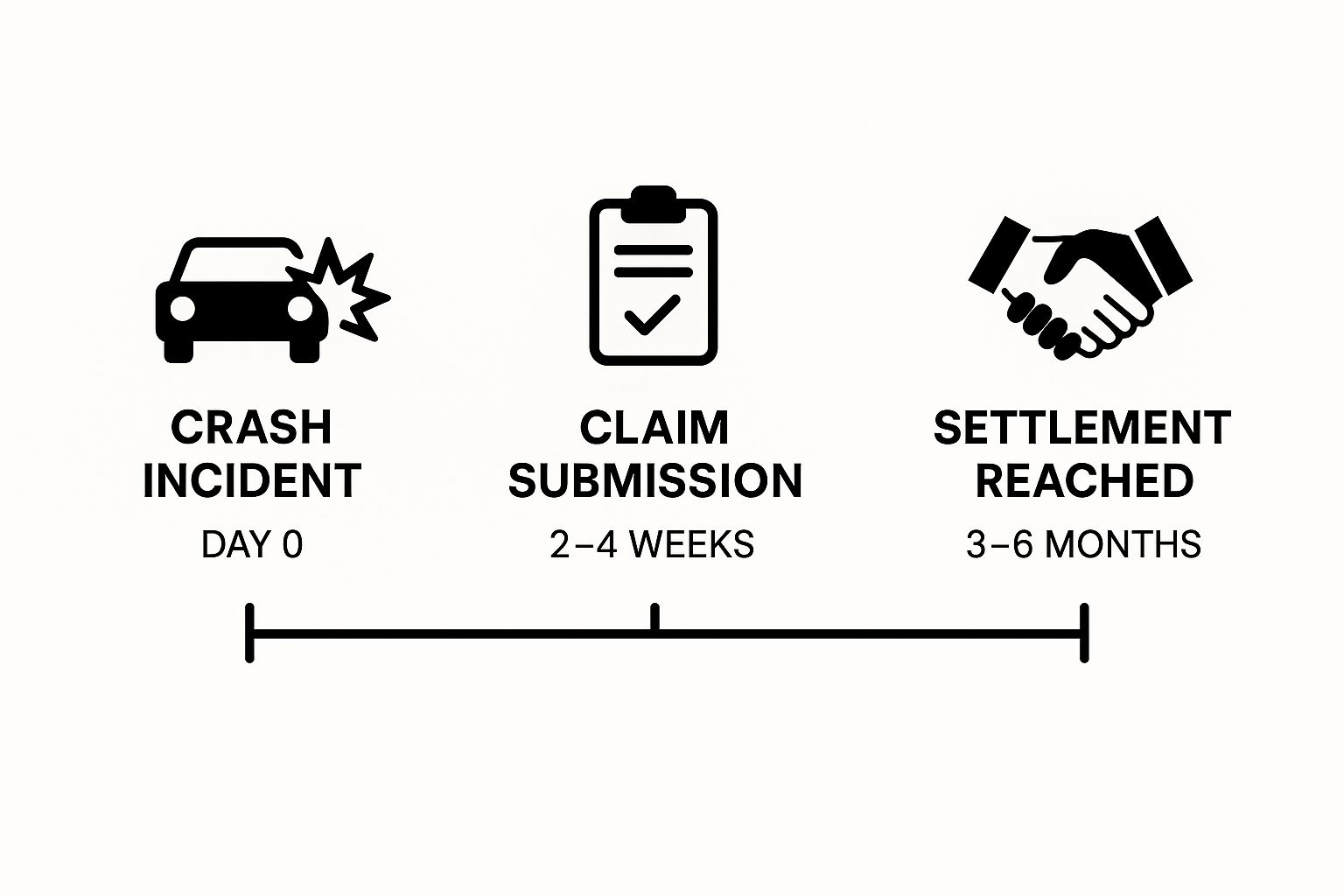

Navigating the Settlement Process Timeline

One of the first questions on everyone’s mind after an accident is, “How long is this going to take?” There’s no simple answer. The journey to a rear-end collision settlement isn’t a straight line; it has distinct stages, and each one takes its own sweet time. Knowing what these stages are helps you set realistic expectations for the road ahead.

Think of it like building a house. You can’t put the walls up before you pour the foundation. You can’t put the roof on until the frame is securely in place. Every step must be completed before moving on to the next, and trying to rush things only leads to a weaker result in the end.

This infographic outlines the typical timeline for a rear-end collision settlement.

As you can see, even a seemingly straightforward case can easily stretch over several months from the day of the crash to the day you get paid.

The Initial Investigation and Treatment Phase

The clock starts ticking the moment the crash happens. For the first few weeks, the focus is split: investigating the accident and ensuring you receive the necessary medical care. Your legal team will be busy gathering crucial evidence like the police report, witness statements, and photos of the scene to build a rock-solid case for who was at fault.

At the same time, your primary focus should be on your recovery. This phase can’t be rushed. It means attending doctor’s appointments, adhering to physical therapy, and following your treatment plan to the letter. How long this takes depends entirely on the severity of your injury.

A huge milestone here is reaching Maximum Medical Improvement (MMI). This is the point where your doctor says your condition has stabilized and you’ve recovered as much as you’re likely to. Settling before you hit MMI is a massive mistake because you won’t know the true cost of your future medical needs.”

The Demand and Negotiation Stage

Once you’ve reached MMI, your lawyer can finally determine the full value of your claim. They’ll gather all your medical records, bills, proof of lost income, and every other piece of documentation into a formal demand letter. This packet is sent to the at-fault driver’s insurance company, which officially initiates negotiations.

And that’s when the back-and-forth really begins. The insurance adjuster will likely come back with a counteroffer, and you can bet it will be significantly lower than what you initially requested. This negotiation dance can take weeks or even drag on for months as your lawyer argues your case, presents the evidence, and fights back against the insurance company’s lowball tactics.

Common Delays and Complicating Factors

While some cases settle relatively quickly, many encounter snags that can significantly prolong the timeline. Knowing what these potential roadblocks are is key to managing your expectations.

Here are a few common reasons things get delayed:

- Disputes Over Fault: If the other driver won’t admit they’re responsible or tries to pin some of the blame on you, the investigation gets a lot more complicated and time-consuming.

- Severity of Injuries: Cases with serious or permanent injuries just take longer. The full extent of future damages has to be calculated carefully, and that’s not a quick process.

- Uncooperative Insurance Companies: Let’s be honest—some insurers drag their feet on purpose. They hope you’ll get frustrated and desperate enough to take a low offer just to be done with it.

The numbers back this up. Research shows that approximately 51% of rear-end collision claims are considered late settlements, meaning they are resolved more than 24 months after the crash. For more details, you can check out the full study on settlement timelines. Dealing with these delays is exactly why having an expert on your side is so important. Our guide on navigating the personal injury claim process offers more insight into what to expect.

The Advantage of Expert Legal Representation

Trying to handle your own rear-end collision settlement is like stepping into the ring for a title fight without a single day of training. In the other corner? An insurance company with a whole team of adjusters and lawyers whose only job is to protect their profits by paying you as little as possible.

This is where everything changes. Working with a specialized law firm, such as those in the Mohr Marketing network, isn’t just about obtaining some legal advice. It’s about leveling the entire playing field. It’s bringing in a pro who already knows every jab, hook, and uppercut the other side is going to throw.

The Power of Specialized Experience

The attorneys Mohr Marketing connects you with live and breathe car accident cases. This isn’t just one small piece of their practice—it is their practice. They uncover the unique details of rear-end collisions, from establishing the other driver’s fault to debunking common excuses and defenses insurers often use.

That sharp focus gives you a serious edge. These experts are fluent in the language of personal injury law and insurance negotiations, making sure every letter, filing, and conversation is laser-focused and effective. They know how to turn your story into a compelling legal case.

Building an Ironclad Case for Maximum Value

A big settlement doesn’t just happen; it’s built on a mountain of solid evidence. An expert attorney acts as the architect of your case, carefully putting every piece in place while you focus on getting better.

The top-tier firms in the Mohr Marketing network manage all the details for you.

This full-service approach includes:

- Proving Fault Beyond Doubt: They’ll pull the police reports, track down and interview witnesses, and can even bring in accident reconstruction experts to paint an undeniable picture of the other driver’s negligence.

- Validating the Full Extent of Injuries: Working closely with your doctors and other medical specialists, they document not just your current pain but your long-term prognosis. This ensures that your future medical care is factored into the settlement demand.

- Calculating All Economic Losses: From paychecks you’ve missed to your diminished ability to earn in the future, they leave no stone unturned to calculate every single dollar the crash has cost you.

This methodical case-building sends a clear signal to the insurance company: we are prepared, we have the evidence, and we will not entertain any offer that doesn’t cover the full scope of our client’s damages.”

This level of preparation is crucial, especially when medical bills and life expenses are mounting. To bridge that financial gap, many clients look for support while their case is ongoing. It’s worth taking a moment to understand what pre-settlement funding is and how it can give you the breathing room your attorney needs to fight for the true value of your claim.

Outmaneuvering Insurance Company Tactics

Insurance adjusters are trained negotiators, and they have a playbook of tactics designed to get victims to accept quick, lowball offers—often before you even know how bad your injuries really are.

A skilled attorney sees these moves coming a mile away. For instance, when an insurer throws out a $5,000 offer for an injury that clearly requires surgery, a lawyer knows it’s not a real negotiation—it’s a test. They’ll fire back with a comprehensive demand letter, backed by all that evidence, forcing the adjuster to take the matter seriously or face a lawsuit.

Ultimately, an attorney’s willingness to go to court is their strongest bargaining chip. The firms Mohr Marketing works with prepare every case as if it’s headed for a jury. This trial-ready approach is often what convinces insurance companies to offer a fair settlement rather than risk a much larger verdict in court. You’ll be negotiating from a position of strength, not desperation.

Your Top Questions About Rear-End Collisions, Answered

After a car crash, your head is spinning with questions and uncertainty. As you begin the process of pursuing a rear-end collision settlement, you need clear, straightforward answers to feel confident and protect your rights.

Let’s cut through the noise and tackle the most common questions we hear from victims. Getting these key points straight can help you sidestep the pitfalls that can seriously weaken your claim.

Is the Driver in the Back Always at Fault?

Most of the time, yes. There’s a strong legal assumption that the driver who hits someone from behind is at fault, but it’s not an ironclad rule. There are definitely exceptions.

What if the driver in front of you slammed on their brakes for no reason? What if their brake lights were out, or they swerved in front of you at the last second? In those cases, they could share the blame—or even be held completely responsible. Proving it, however, requires a thorough investigation, and this is exactly where the legal experts in the Mohr Marketing network excel. They dig deep to find the evidence that assigns fault correctly.

Should I Take the First Settlement Offer?

Let me be blunt: accepting the first offer from the insurance company is almost always a bad move. Think of it as their opening bid in a negotiation—it’s a lowball number designed to make your case go away as fast and as cheaply as possible.

That initial offer almost never covers the true cost of your accident. It won’t account for future physical therapy, lost promotions at work, or the real toll of your pain and suffering. An experienced attorney has seen this playbook a thousand times. The firms Mohr Marketing partners with will spot an unfair offer instantly and counter with a detailed demand package, forcing the insurer to the table for a genuine negotiation.

How Much Time Do I Have to File a Claim?

This one is critical. Every state has a strict deadline for filing a personal injury lawsuit, called the statute of limitations. This window can be as short as one year from the day of the accident. If you miss that deadline, your right to seek compensation is gone. Forever.

Because the clock is ticking, you have to act fast. Engaging a skilled attorney promptly ensures that all necessary paperwork is filed correctly and on time. It protects your claim from being dismissed on a simple technicality.

Making your way through a rear-end collision claim is complex. You’re up against insurance companies with their own tactics and goals. The legal professionals in the Mohr Marketing network are built to handle every single part of your case, from the first investigation to the final negotiation. This lets you focus on what matters—your recovery—while they fight for the maximum settlement you deserve. Don’t leave your future up to chance. Find out more at https://www.mohrmktg.com.

We also have Spanish-speaking intake staff.

For more information, check out our website:

Best Wishes,

Sue Mohr

Recent Posts

- Is Your Marketing Vendor Making You an Accomplice?

- Is your lead vendor compliant? Your License May Be At Risk

- Why Joint Advertising is the Only Safe Harbor for Law Firms

Categories

- AI and Lead Generation

- Business Financing

- Call Verified MVA Leads

- Car Accident Help

- Car Accident Settlements

- Claimant Funding

- Compliance Program

- Geotargeting

- Google Maps Ranking

- Healthcare Practice Growth

- Law Firm Growth

- Law Office Operations

- Lead Generation

- Lead Generation For Attorneys

- Lead Generation For Chiropractors

- Lead Generation For Criminal Attorneys

- Lead Generation For D&A Treatment Centers

- Lead Generation For DUI Attorneys

- Lead Generation For Eye Doctors

- Lead Generation For Family Law Practices

- Lead Generation For PI Law Firms

- Lead Generation For Plastic Surgeons

- Leads For Healthcare Professionals

- Leads For Insurance Industry

- Legal Leads

- Legal Marketing

- Legal Updates

- Mass Tort Leads

- Medicare and Medicaid Leads

- Merchant Funding Leads

- Online Marketing Strategies

- Pre-Settlement Funding

- Signed MVA Cases

- Tort Updates

- Truck Accident Settlements

- Web Design

Archives

Copyright © 1994-2025 Mohr Marketing, LLC. All Rights Reserved.